Made by Accountants for Accountants

AI-Powered Tax Compliance for Australian Accountants

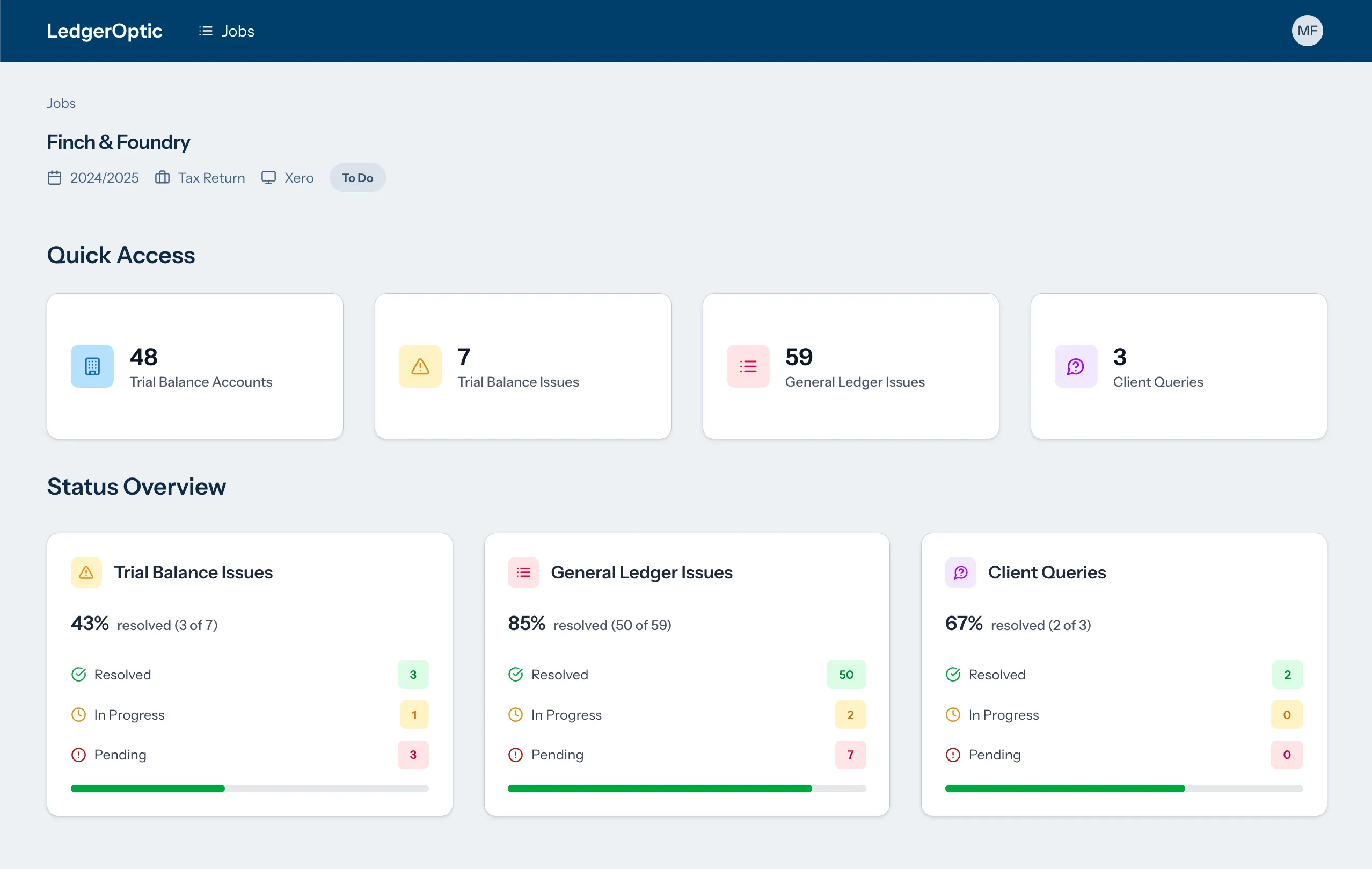

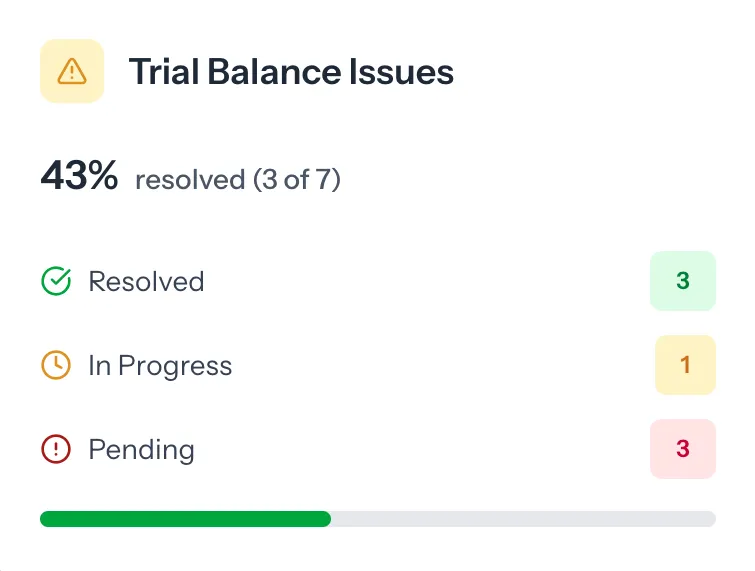

LedgerOptic helps accountants to prepare annual business tax compliance faster. It highlights key risks, including accounting errors, tax issues, GST discrepancies, and outstanding client queries.

Trusted by accounting teams across Australia

Faster reviews, fewer surprises

From non-deductible transactions to client queries, LedgerOptic highlights issues to be resolved clearly, reducing review time and ensuring nothing slips through.

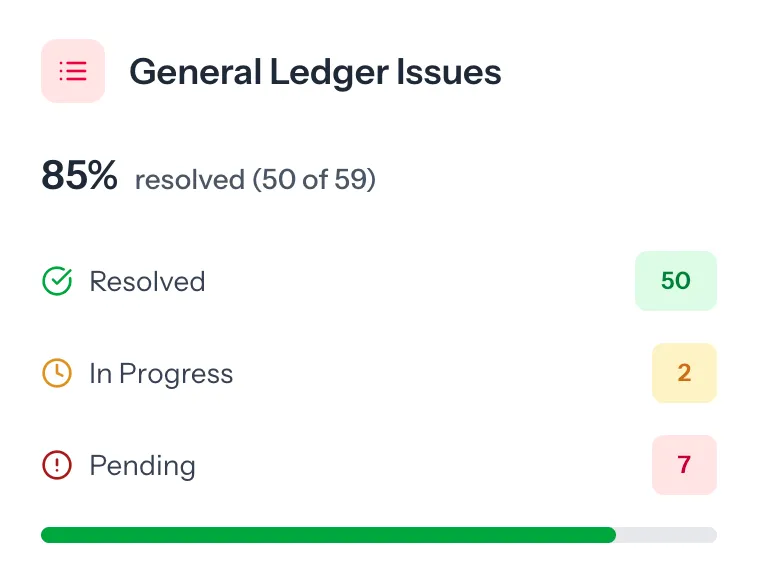

Analyse transactions in minutes, not hours

LedgerOptic automates transaction review, giving accountants rapid, reliable insights while reducing compliance risk.

Spot misallocations instantly

Catch GST errors early

Flag non-deductible spend automatically

Flag tax reconciliation items for review.

Instantly flag client queries.

Identify FBT issues proactively.

Detect complex tax issues such as Div7a.

Spot compliance risks before the ATO does

LedgerOptic reviews client accounts and individual transactions to uncover compliance risks, helping firms reconcile and prepare business tax returns fast and more accurately reducing ATO exposure and increasing profitability.

Flag depreciation and other tax reconciliation items.

Identify payroll issues for faster reconciliation.

Spot late-paid super contributions.

Highlight potential Motor Vehicle FBT issues.

Reconcile Fixed Asset registers.

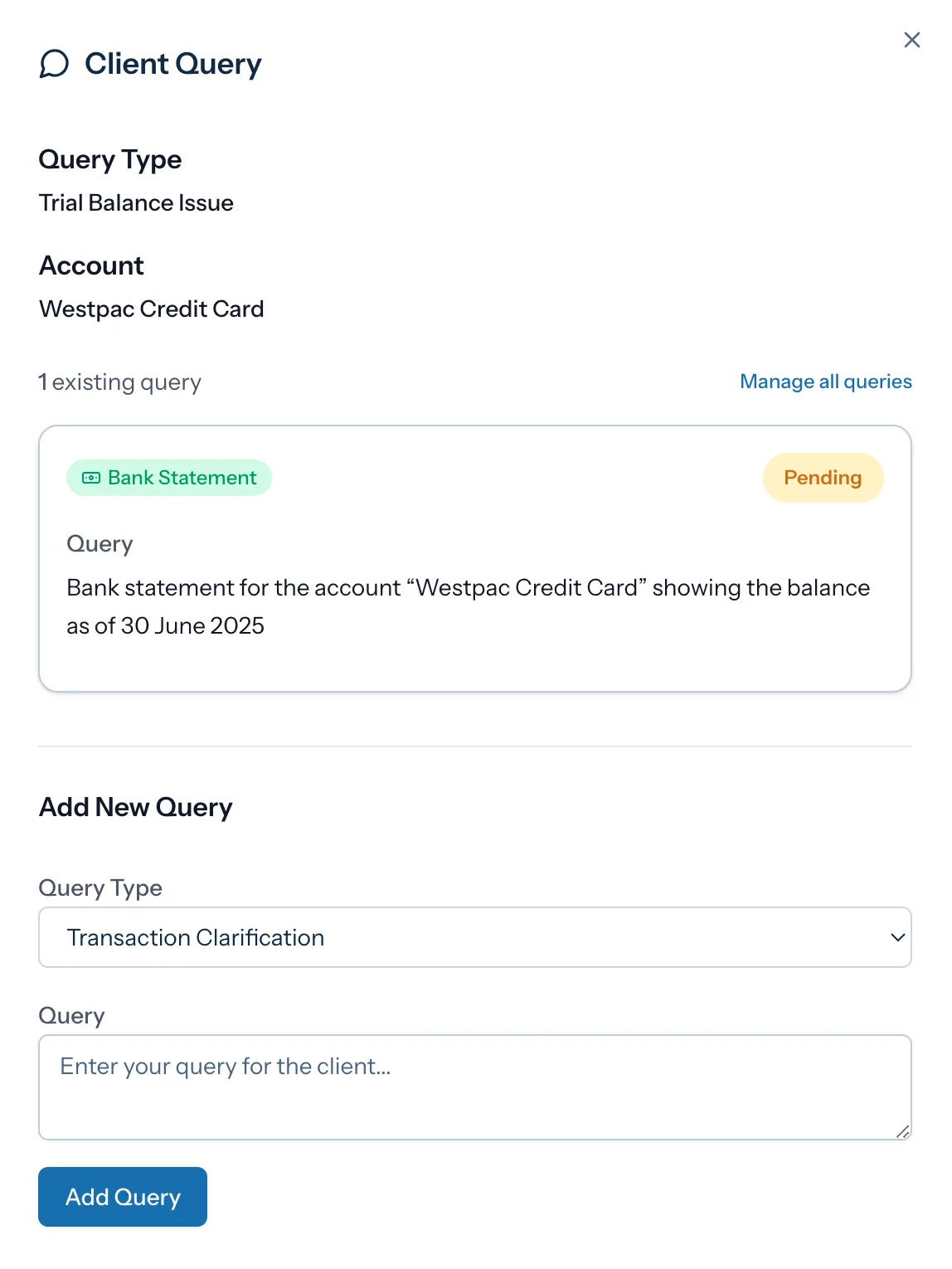

Manage client queries with ease

LedgerOptic helps accountants capture, track and communicate client queries, combining manual flags with automatic detection for smoother workflows.

Flag transactions during review

Record questions against accounts

Organise queries in one place

Automate generating client emails

Automate common query detection

Frequently Asked Questions

Quick answers for Australian tax agents exploring LedgerOptic.

01Is my client data used to train AI?

02Who can see my firm’s data?

03How is my data protected?

04Where is my data stored?

05What happens if I want to leave?

Ready to see LedgerOptic in action?

Book a personalised walkthrough to learn how LedgerOptic streamlines compliance reviews, surfaces ledger risks, and saves your firm hours each week.